[ad_1]

Posted on: February 23, 2023, 01:11h.

Final up to date on: February 23, 2023, 01:23h.

One of many largest institutional buyers in DraftKings (NASDAQ: DKNG) inventory decreased its publicity to shares of the web sportsbook operator.

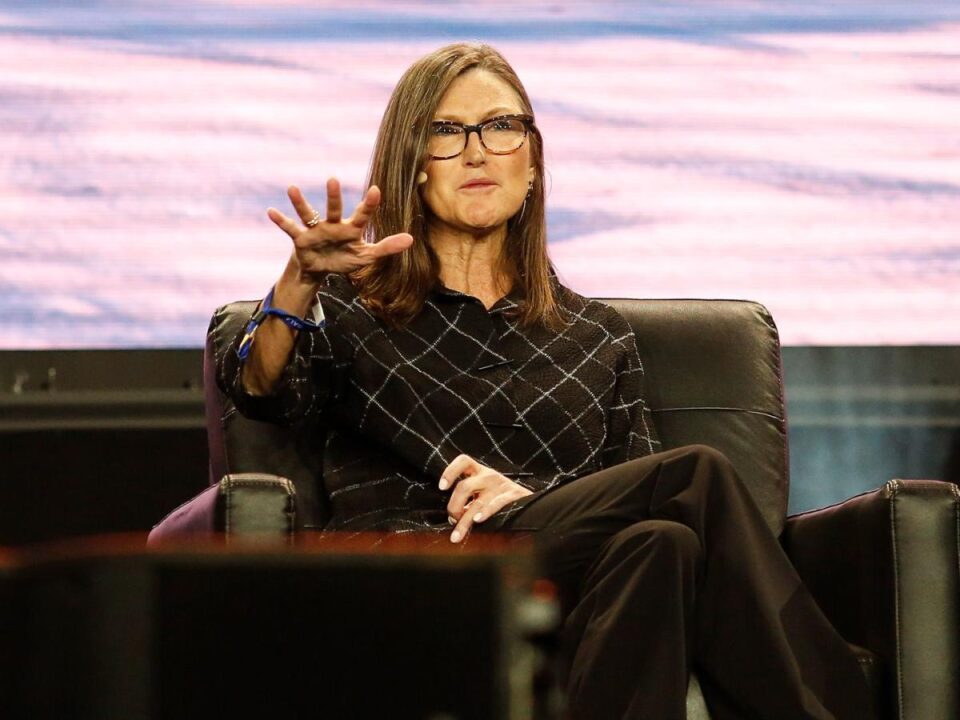

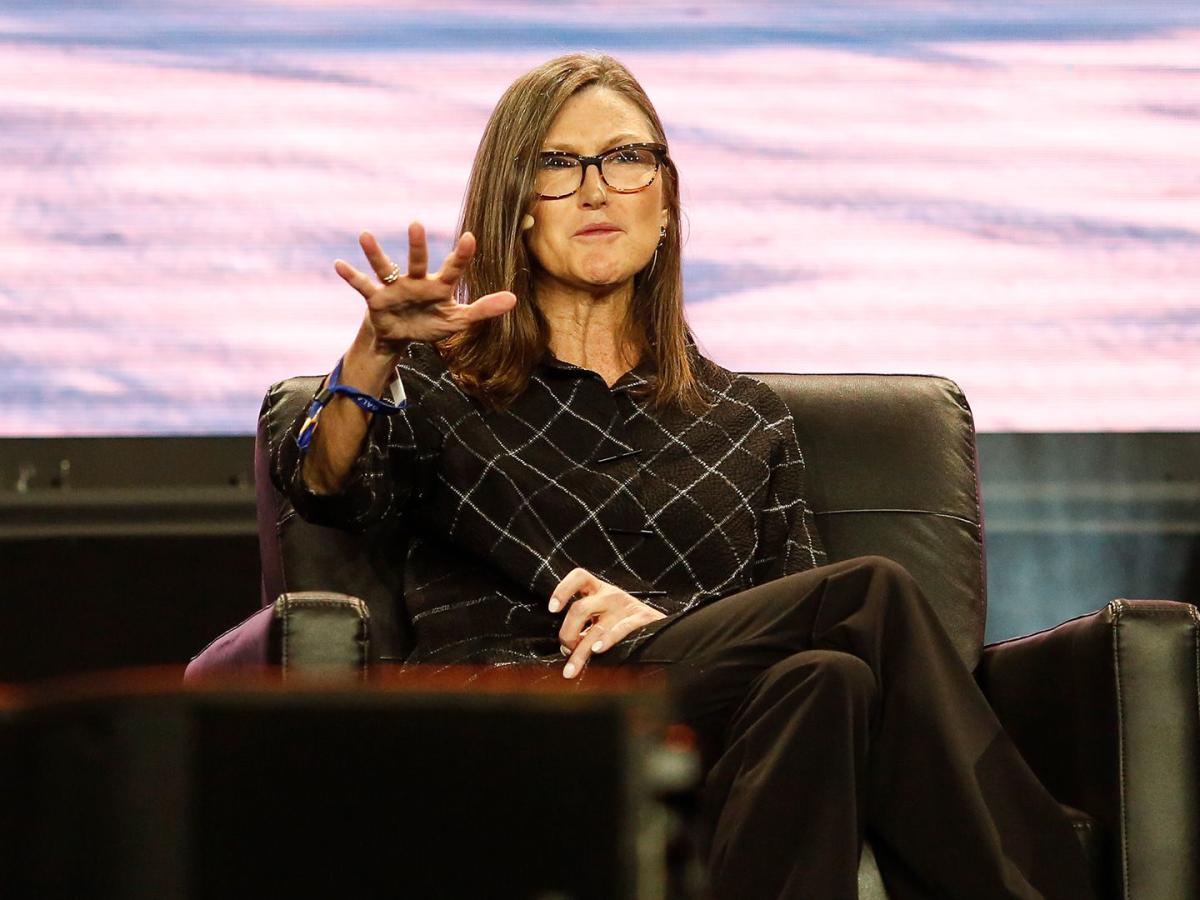

On Wednesday, Cathie Wooden’s ARK Funding Administration bought 207,747 shares of the gaming firm because the inventory cooled from a current rally — a situation that’s persisting right now. Getting into Thursday, the inventory was increased by 6.16 over the previous week — largely the results of an encouraging 2023 outlook delivered final week by the corporate.

Home fairness markets retreated over the previous couple of days amid expectations that the Federal Reserve might need to be extra aggressive than hoped relating to tighter financial coverage this yr. Rising rates of interest are drags on progress corporations, resembling DraftKings, as a result of these elevated borrowing prices make the longer-dated money flows of progress companies much less interesting.

Rising charges are notably onerous for corporations that aren’t but worthwhile, which is the case with DraftKings although the operator forecasted profitability in 2024.

Even with weak spot in current periods, shares of DraftKings are increased by 65.74% year-to-date, indicating ARK had some runway with which to trim its publicity to the inventory at favorable costs.

ARK Nonetheless a Huge DraftKings Backer

On February 22, Florida-based ARK Make investments bought 178,593 shares of DraftKings from the ARK Innovation ETF (NYSEARCA: ARKK) – the agency’s flagship exchange-traded fund (ETF). It additionally bought 29,154 shares of the gaming inventory out of the ARK Subsequent Era Web ETF (NYSEARCA: ARKW).

These strikes aren’t essentially a pox upon the longer-ranging DraftKings funding. The majority of the ETFs within the ARK steady, together with the aforementioned ARKK and ARKW, are actively managed. Meaning holdings can change each day. It’s additionally potential that Wooden’s agency pared its DraftKings stake to lift money for different alternatives.

ARK’s Wednesday gross sales of DraftKings fairness are modest relative to the asset supervisor’s total holdings of the sportsbook operator. On the finish of 2022, the ETF issuer owned 25.03 million shares of the gaming inventory. Amongst fund issuers, solely Vanguard owned extra. Total, ARK is the third-largest institutional investor in DraftKings behind UBS and Vanguard.

It’s additionally price noting that ARK has been a DraftKings supporter, and it’s commonplace for the agency to sometimes cut back stakes in a few of its favourite shares.

ARK Bullish on Sports activities Wagering

Along with its possession of DraftKings inventory and a much smaller place in sports activities betting information supplier Genius Sports activities (NYSE: GENI), ARK Make investments is broadly bullish on the long-term sports activities wagering funding thesis.

Within the agency’s just lately revealed 2023 “Huge Concepts,” ARK forecasts that on-line sports activities betting deal with within the US and Canada will bounce at a compound annual progress price (CAGR) of 27% over the subsequent 5 years.

ARK added it sees deal with approaching $330 billion in 2027 — one of the crucial bullish forecasts within the funding administration business.

[ad_2]

Source link